How can you balance financial protection with potential growth?

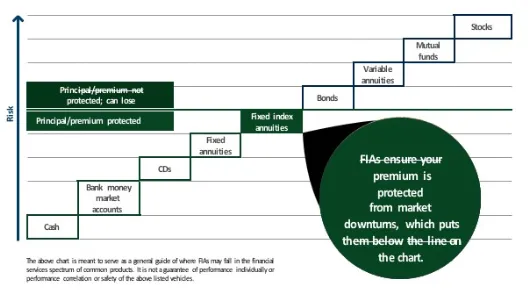

Balance is key in all aspects of life. Understanding risk-return balance is essential for meeting financial and retirement goals. When creating a financial retirement plan, there is no one “best” product. But some products can be a better fit to help meet your goals. View how various products fair in terms of risk, and then consider how a fixed index annuity [FIA] might play a part in your retirement accumulation strategy, offering both upside potential and premium protection against market risk.

Fixed index annuities

How they perform in up and down markets

Fixed index annuities [FIAs] generally credit a portion of total index gains based on the crediting method chosen, but don’t lose value due to market downturns.

How Does An Indexed Annuity Grow?

The Nuts & Bolts

With an indexed annuity, your return is based on the performance of a particular financial index, such as the Nasdaq or S&P 500. The index’s performance determines how much your annuity will grow. If the index goes up, your annuity value will increase. If the index goes down, your annuity value will NOT decrease.

You may choose to diversify into multiple index options and change those options each year upon account renewal periods.

How much of the index performance credited to the annuity is normally dictated by a Participation Rate which is a percentage of the index return credited to the account.

Example:

Mr.Jones has an Indexed Annuity Allocated into the S&P 500. His participation rate is 50%.

If the S&P 500 receives a return of 20% over a 1 year period, he will receive a 10% gain in his annuity. (50% of the return)

Can You Lose?

Short Answer is no, the only way your account will decrease is based on a withdrawal or Fee (which we do not like fee based annuities).

Example:

If the S&P 500 receives a loss of -20%, his account will have a gain of 0%. He will never receive a negative return, even if the index does.

We call this the Power Of Zero!

Indexed annuities guarantee you will not lose money even if the index declines. This guarantee is provided by the insurance company that issues the annuity.

Source:

Paul Metzler

Metzler Retirement

📞 (610) 420-4035

📩 [email protected]

@ www.metzlerretirement.com

Copyright © 2022 All rights reserved.

Our mailing address is:

124 Dieber Road Schwenksville 19473 Pennsylvania United States.

Want to change how you receive these emails?