Volatility

Are you overexposed?

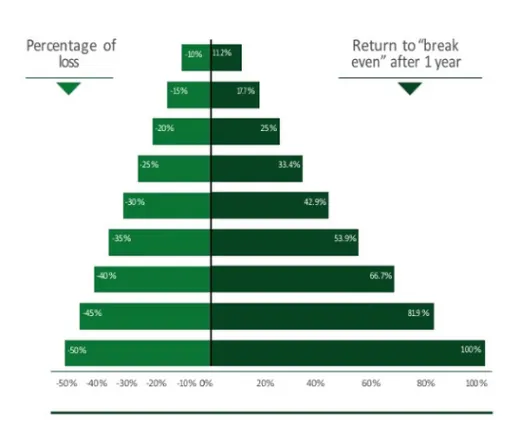

Market volatility continues to rise on bothh the gains and losses front. Those with all their retirement assets exposed to market volatility have seen both historic gains but also historic downturns. While the overall long-term value of the market is a net positive, many consumers have concerns about volatility impacting their assets as they approach retirement. Consider for example, what kind of gain is needed to recover from a market loss.

Volatility Is A Bully - Take Control Back!

Averages Mean Nothing In Retirement

Return sequence, or return sequencing, is a phrase used to describe the year-over-year investment returns experienced by a portfolio for a select period. This sequence could look something like this over a 5 year period:

Year 1 Return: 5.00%

Year 2 Return: -2.00%

Year 3 Return: -10.00%

Year 4 Return: 7.00%

Year 5 Return: 15.00%

Average = 3% Yearly

If you have $100,000 invested during this example 5 year period this is what your portfolio would have looked like:

Starting Amount $100,000

After Year 1: $105,000

After Year 2: $102,900

After Year 3: $92,610

After Year 4: $99,092.70

After Year 5: $113,956.60

Average = 3% Yearly

That is an example of a Return Sequence.

Fixed Interest Instead of Average

What if you received a fixed rate of interest at 3% each year, would your account be the same value?

Lets check it out!

Starting Amount $100,000

Year 1 Return/Amount: 3.00% / $103,000

Year 2 Return/Amount: 3.00% / $106,090

Year 3 Return/Amount: 3.00% / $109,272.7

Year 4 Return/Amount: 3.00% / 112,550.88

Year 5 Return/Amount: 3.00% / $115,927.41

Wait, why is it more if it is the exact same average of 3% in both examples?

Lets look back at the graph above!

When you have a loss in a portfolio from market volatility or a withdrawal that made the account decrease you now find yourself in a hole that you have to climb out of. That requires a larger gain needed to return back to break even from the prior year.

The graph above shows how much of a return you would need to break even after a loss.

A 50% loss would need a 100% gain to break even. Is that possible?

Short answer - NO!

A Fixed & Indexed Annuity eliminates this risk due to your account always have a floor of 0%, meaning you can never experience a loss.

The more you know.

Paul Metzler

Metzler Retirement

📞 (610) 420-4035

📩 [email protected]

@ www.metzlerretirement.com

Copyright © 2022 All rights reserved.

Our mailing address is:

124 Dieber Road Schwenksville 19473 Pennsylvania United States.

Want to change how you receive these emails?